Scrolling through TikTok or Instagram, it feels like everyone is living the “soft life.” Brunch dates with bottomless mimosas. Solo trips to Bali. Skin care hauls that cost more than your entire grocery budget. The message is loud: life is meant to be enjoyed, not endured.

But then reality hits, you’ve got rent due, your student loan payment is lurking, and your debit card balance isn’t matching the soft life vibe. The tension is real: how do you enjoy the good things in life without sabotaging your financial future?

Let’s break it down.

What Soft Life Really Means

The soft life trend is more than just luxury bags or fancy trips. At its core, it’s about peace, ease, and not being stuck in struggle mode. For many of us especially students and young adults grinding through school or first jobs, the idea of choosing joy, comfort, and experiences feels like a rebellion against constant hustle culture.

The danger? Soft life can get expensive if it’s only defined by “treat yourself” moments. If your idea of ease comes with a hefty credit card bill, you’re just trading today’s peace for tomorrow’s stress.

The Money Reality Check

Financial responsibility isn’t as glamorous as an aesthetic coffee run, but it’s the foundation that allows you to truly enjoy life long-term. Think of it this way: soft life without savings is short-lived. Real-life bills and future goals (graduating debt-free, moving into your own place, traveling without guilt) need attention too.

So the real question isn’t “soft life or real life?” it’s how do you balance both?

Practical Ways to Live Soft and Save Smart

Here’s how you can still enjoy your “soft life” moments without blowing your budget:

1. Pick Your Luxuries

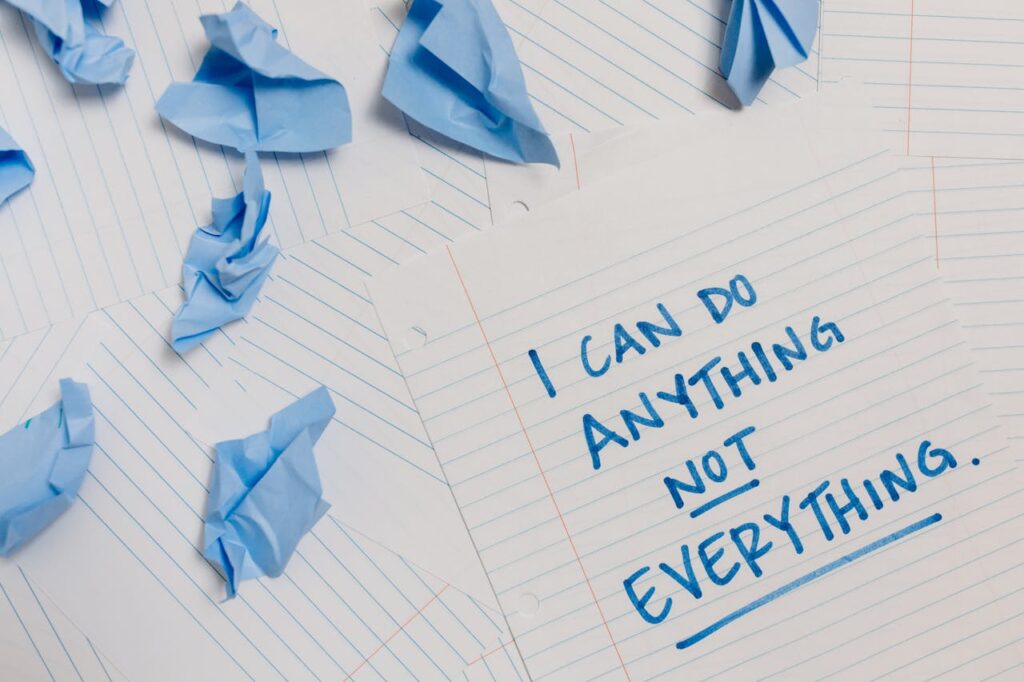

You don’t need to say yes to every soft life trend. Maybe it’s skincare for you, maybe it’s weekend brunch, or maybe it’s travel. Choose 1–2 areas to splurge on and keep the rest simple. That way, you still get the joy without draining your wallet.

2. Set a “Soft Life Budget”

Literally give yourself a line in your budget called “soft life.” Whether that’s $50 a month as a student or $150 as a young professional, that’s your guilt-free spending zone. Once it’s gone, it’s gone but you can enjoy it fully without stressing.

3. Romanticize the Everyday (for Free)

The truth is, soft life doesn’t have to mean luxury. Lighting a candle while you study, going for a walk in nature, or cooking a fancy meal at home can feel just as indulgent. Real peace comes from slowing down, not necessarily spending more.

4. Save First, Then Spend

Flip the script: instead of saving what’s left after spending, spend what’s left after saving. Even if it’s just $20 a paycheck, it builds discipline and future freedom. Soft life feels sweeter when you know your future self is secure.

5. Invest in Experiences, Not Just Things

That $100 bag might not hit the same in a year, but a weekend trip with friends or a cooking class could give you memories you’ll still laugh about later. Prioritize what truly adds value.

For College Students and Young Adults

If you’re in college or just starting your career, this is the best time to learn balance. It’s tempting to live fully in the moment (“YOLO, I’m young”), but the small habits you build now, saving even when it feels impossible, setting spending boundaries, compound over time.

Think about it: your future self will thank you for choosing both joy and discipline. You don’t have to reject the soft life, but you can redefine it so it doesn’t come with a side of debt.

My Final Thoughts

So, can you live the soft life and still save money? Absolutely. But it requires intentional choices. Living soft isn’t about avoiding hard work or ignoring responsibilities, it’s about designing a life that feels good now while setting yourself up for peace later.

Luxury doesn’t have to mean reckless spending. Balance is the real flex.

💌 Let’s Stay Connected!

If this post resonated with you, I’d genuinely love to hear from you.

And hey, don’t miss future posts like this!

Subscribe here to get notified when new blogs drop. Let’s grow, glow, and walk this faith journey together 🤍✨

Want to take it a step further?

Join our Community Forum! Share your thoughts, ask questions, or encourage others on their faith journey. If you haven’t already, create your profile below and jump in on various topics on the Forum.

Wanna connect more personally?

Follow on social media for daily encouragement, lifestyle reflections, and real-time updates:

Let’s keep doing life together with purpose, with grace, and with God at the center. 💫

Would you like me to pray with you? Share your prayer requests below, and we’ll lift you up in prayer.

4 responses to “Can You Live the Soft Life and Still Save Money?”

-

It’s refreshing: the idea that you don’t have to sacrifice your rest or rhythm to save. You can live softly and still build wisely.

-

What do you think? Do you feel pressure to keep up with the “soft life” trend, or are you finding your own version of balance?💭

-

The pressure is real sometimes, but I remind myself that balance looks different for everyone. My soft life might be simpler than others, and that’s okay.

-

That’s a good mindset!!

-

-

Leave a Comment